Bill Gates In Riyadh and Omar Al Shabaan, leading The Garage | الكــراج. In a landmark event for the Saudi Arabian tech landscape, 100 plus billions USD fortune tech mogul Bill Gates, co-founder of close to 3 trillion USD valuation Microsoft, visited The Garage | الكــراج in Riyadh, a central hub for technological innovation and entrepreneurship. This visit marks a significant milestone for The Garage | الكــراج, situated in King Abdulaziz City for Science and Technology, as it underscores the burgeoning tech scene in Saudi Arabia. With over 300 startups and attracting participants from around 50 countries, The Garage | الكــراج is not just a physical space but a symbol of Saudi Arabia‘s rapid growth in the tech sector. Gates‘ visit highlights the global interest in the region’s tech potential, with The Garage | الكــراج playing a pivotal role in shaping this landscape. This article offers a glimpse into how The Garage is driving the tech revolution in the Middle East, with Bill Gates‘ engagement underscoring its international relevance and impact.

The Garage | الكــراج

Bill Gates‘ visit to The Garage | الكــراج, a startup hub in Riyadh, represents a significant event in the tech world. The Garage | الكــراج is known as the largest startup district in the Middle East, located within the King Abdulaziz City for Science and Technology in Riyadh. This space covers 28,000 square meters and houses over 300 startup companies. It has been a hub for more than 40 events, attracting participation from 150 domestic and international startups and more than 3,500 attendees, including partners, investors, and industry experts. The facility is now open to founders who wish to join this vibrant community and benefit from an ecosystem of partners and innovators.

Omar Al Shabaan, leading The Garage, has played a crucial role in attracting these startups from around 50 countries, underlining the hub’s international appeal and its significance in fostering technological innovation and entrepreneurship in the region.

This visit by a figure like Bill Gates and the leadership of Omar Al Shabaan highlights the growing importance of The Garage | الكــراج as a central point for tech innovation and startup culture in the Middle East.

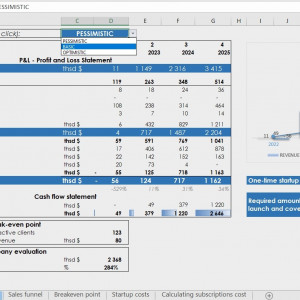

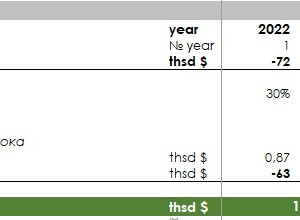

The Venture Capital Landscape Example: Saudi الشركة السعودية للاستثمار الجريء Venture Capital Company (SVC)

Saudi Venture Capital Company (SVC) has been actively reinforcing its role in the Saudi Arabian tech landscape with significant investments. In a recent development, SVC launched an $80 million investment fund dedicated to the fintech sector. This ‘Investment in Fintech VC Fund‘ was initiated in collaboration with Saudi Arabia’s Capital Market Authority and the Financial Sector Development Program, aimed at preserving the Kingdom’s fintech industry growth.

Insights with H.E Dr. Nabeel Koshak CEO of Saudi Venture Capital Company (SVC) and MAGNITT by CEO

In 2022, the fintech sector in Saudi Arabia attracted almost 25% of all venture capital funding in the country, emphasizing the sector’s burgeoning status. Moreover, Saudi Arabia’s venture capital market captured $987 million in funding last year, a 72% increase from the year before, even as global investment trends showed a decrease.

Additionally, SVC invested $30 million in Fund III, a move that underscores its commitment to fostering growth-stage companies in Saudi Arabia and contributing to their development towards the pre-IPO stage. Fund III is focused on supporting high-potential growth-stage companies across various industries, aiming to bolster Saudi Arabia’s technological infrastructure and establish it as a leading hub for innovative startups. This strategic investment is set to empower entrepreneurially driven activities in the region and amplify the chances of success for these startups in the competitive market.

Mohammed bin Salman Al Saud and Bill Gates In Riyadh (Before)

Mohammed bin Salman Al Saud

GAIA by NextGrid AI accelerator. The Bill Gates AI Destination.

Bill Gates and the Bill & Melinda Gates Foundation to our accelerator GAIA AI Accelerator by NextGrid

Spend Bill Gates Money

- Who is Mohammed bin Salman Al Saud?

Mohammed bin Salman Al Saud, commonly known as MBS, is a transformative figure in the global political and economic landscape. As the Crown Prince of Saudi Arabia, he has initiated significant reforms under Vision 2030, a strategic framework to diversify Saudi Arabia’s economy and reduce its dependence on oil. This vision includes transforming the kingdom into an investment powerhouse and a hub connecting three continents. The initiative covers various sectors, including technology, tourism, and entertainment, and aims to establish an e-government system by 2030.

In September 2022, MBS was appointed as the Prime Minister of Saudi Arabia, formalizing his role as the head of the government and marking a shift in the traditional power structure of the kingdom. This position was previously held by the king, indicating a gradual transfer of power.

MBS has been actively reshaping Saudi Arabia’s foreign relations, demonstrated by his discussions with global leaders like Russian President Vladimir Putin. He has played a pivotal role in OPEC+ negotiations, influencing global oil market dynamics. However, his tenure has been marked by controversies, including the Yemen conflict and the involvement in the killing of journalist Jamal Khashoggi. His leadership style is characterized by a mix of economic liberalism and political authoritarianism, with a crackdown on dissent within the kingdom.

Under MBS’s leadership, Saudi Arabia is increasingly asserting itself as a regional power, with initiatives like the Riyadh Season and the Red Sea Festival, enhancing the kingdom’s cultural and entertainment landscape. The Riyadh Season, which began on October 28, has become a significant attraction, drawing over 5 million visitors in less than a month. The event features a wide range of high-quality entertainment events, exhibitions, and concerts, showcasing Saudi Arabia’s growing emphasis on tourism and leisure.

In the tech startup ecosystem, Saudi Arabia has made notable strides with the launch of “The Garage,” the Middle East’s largest startup hub. Located in Riyadh, The Garage covers 28,000 square meters and houses over 300 startups. It offers a range of facilities and programs to foster innovation, including partnerships with industry giants like Google for Startups. The Garage has already graduated more than 230 startups, demonstrating Saudi Arabia’s commitment to fostering a vibrant startup ecosystem and innovation culture.

MBS’s leadership and decisions continue to shape Saudi Arabia’s trajectory, reflecting a blend of ambitious economic reforms, strategic diplomatic engagements, and controversial domestic policies. - When did Mohammed bin Salman Al Saud meet Bill Gates?

- How old is Bill Gates?

- Where does Bill Gates live?

- How to spend Bill Gates money?

- Who is Omar Al Shabaan?

- What is the purpose of Fund III launched by Saudi Venture Capital Company (SVC)?

Fund III aims to support the development of technology startups, invest in high-potential growth-stage companies, and contribute to the technological advancements in the MENA region. With SVC’s investment of $30 million, the fund is poised to fuel growth and innovation, helping to position Saudi Arabia as a key hub for burgeoning technology enterprises.

- How much has the Saudi Venture Capital Company (SVC) invested in startups and SMEs?

The Saudi Venture Capital Company (SVC) has made substantial investments totalling $2 billion in Assets Under Management (AUM), supporting over 700 startups and SMEs through various Private Capital Funds, including Venture Capital, Private Equity, Venture Debt, and Private Debt funds. This showcases SVC’s significant role in fostering the growth of high-potential businesses in the region.

The Saudi Venture Capital Company (SVC) has made significant investments in various startups and industries. Their portfolio includes investments in 17 companies, with an average round size of $3 million. SVC focuses on diverse sectors such as Information Technology, E-Commerce, Software, Retail, and Mobile Apps. Notable investments include companies like BALLURH in Information Technology, Lawazem in B2B E-Commerce, and BARQ in Logistics. These investments reflect SVC’s commitment to fostering a dynamic and varied startup ecosystem in Saudi Arabia.

December 20, 2023