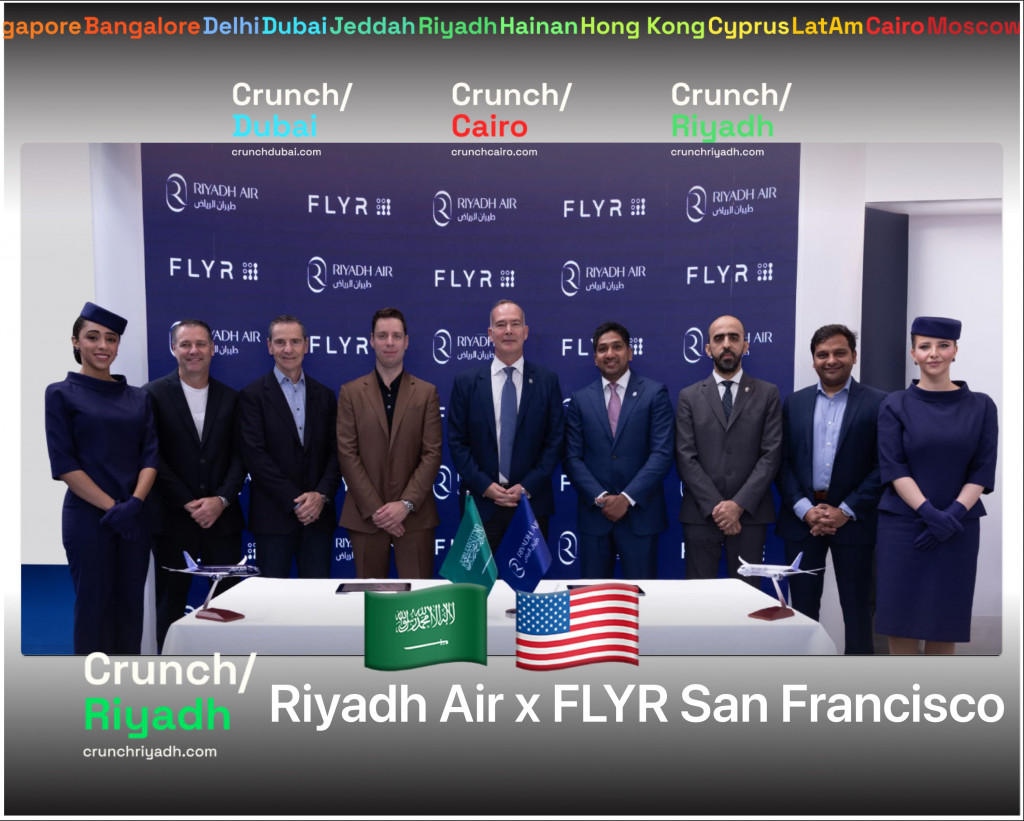

We as always checking key people from Riyadh Air and FLYR… Riyadh Air: Tony Douglas (CEO), Yasir Othman Al-Rumayyan (Chairman), Princess Haifa bint Mohammed Al Saud (Director), Prince Dr. Faisal bin Abdulaziz bin Ayyaf (Director), 1Mohammad Mazyad Al-Tuwajiri (Director), Ibrahim Mohammed Al Sultan (Director), Raid Abdullah Ismail (Director), Sami Ali Sindi (Director), Alexandre de Juniac (Director), Faraz Khaled (Director), Ray Gammell (Chief Corporate Development & Enablement Officer), Adam Boukadida (Chief Financial Officer), Osamah Alnuaiser (SVP Marketing & Corporate Communication), Vincent Coste (Chief Commercial Officer), Peter Bellew (Chief Operations Officer)… FLYR: Alex Mans (Founder and CEO), Steve Schoch (Chief Operating Officer & CFO), John Tzioufas (Chief Revenue Officer), Matt Brown (Vice President of Growth), Mark Treschl (Chief Customer Officer), Cole Wrightson (Chief Product Officer), Gabriel Underwood (VP of Engineering), Kartik Yellepeddi (VP of Product, Offer & Order), Jon Ham (Head of ML Analytics), Christie Engelbrecht (Chief Communications Officer).

Why USA and not KSA vendor?

If you have any ideas let us know in the comment section, we will just make comparisons below 👇 between FLYX from San Francisco and similar Kingdom of Saudi Arabia vendors of similar technology stack with some market numbers in $:

Part 1: Investors and Relevant Experience

FLYR, based in San Francisco, has attracted significant investment to fuel its growth, particularly in the travel technology space. In August 2024, FLYR raised $295 million in a funding round led by WestCap, with participation from BlackRock, Streamlined Ventures, and a subsidiary of the Abu Dhabi Investment Authority (ADIA) . WestCap, led by Laurence Tosi, brings deep experience from ventures like Airbnb and Hopper, adding valuable operational expertise to FLYR’s board . With this backing, FLYR has become one of the most well-funded companies in its niche, raising over $500 million to date.

FLYR leverages its AI-based platform to modernize revenue management, demand forecasting, and pricing optimization for major airlines like JetBlue, Avianca, and Virgin Atlantic, positioning itself as a disruptor in a sector dominated by legacy systems. The total value of these types of partnerships can range from $50 million to $200 million per major airline contract, depending on the size of the fleet and scope of services . FLYR’s platform is designed to reduce costs, increase revenue, and integrate seamlessly with existing systems—appealing to airlines in need of rapid digital transformation.

In Saudi Arabia, investors such as Sanabil Investments (a subsidiary of the Public Investment Fund, PIF), have backed significant projects in the technology and aviation sectors, including partnerships in digitizing air travel. Riyadh Air, supported by the PIF, represents a $30 billion project aimed at making Saudi Arabia a global aviation hub. Companies like FLYR are crucial for such an ambitious vision, but Saudi Arabia is also home to emerging local players in this space, offering similar AI-driven services in transportation and travel technology .

Part 2: Comparison Between FLYR and Saudi Arabian Vendors

1. FLYR (San Francisco):

• Core Strengths: AI-powered revenue management, demand forecasting, deep learning applications, and offer management solutions.

• Global Market Share: FLYR has partnerships with major international airlines, positioning it as a $500M+ valuation company, with contract values from $50M to $200M depending on the scope .

• Key Differentiator: FLYR provides modular technology compatible with legacy airline systems, allowing seamless integration and real-time optimization.

2. Saudi Arabia Vendors:

• Examples: Companies like Elm and STC Solutions have ventured into transportation technologies. Elm is known for its digital transformation services in public and private sectors, including projects for the Saudi Ministry of Transport. STC Solutions, part of Saudi Telecom, is also growing in AI-driven systems, offering data analytics and digital transformation solutions for transportation.

• Market Share: The combined revenues of leading Saudi tech companies in transportation solutions are estimated at around $1 billion, with contracts spanning across government and private enterprises . These vendors primarily focus on digitization and providing end-to-end AI solutions, but they often lack the specialized deep learning capabilities of FLYR in aviation.

Contract Value Comparisons:

• FLYR deals with contracts ranging from $50M to $200M for major airline partnerships, particularly focused on revenue optimization and passenger experience .

• Saudi Vendors: Local vendors tend to secure government contracts, typically in the range of $20M to $100M, depending on the size of the digital transformation project, particularly in sectors like logistics and transportation .

Summary: While FLYR’s expertise in specialized AI for aviation makes it a leader in the global market, Saudi vendors like Elm and STC Solutions focus more broadly on AI-driven government projects and digital transformation initiatives. For Riyadh Air, a partnership with FLYR provides advanced global technology but may complement future collaborations with local vendors

October 12, 2024